FX Shield Alpha

Algorithmic Strategy Architecture:

Quantitative Risk Recovery Strategy (QRRS)

The Quantitative Risk Recovery Strategy (QRRS) is a sophisticated algorithmic trading system engineered for institutional and professional investors seeking asymmetric returns with tightly controlled risk profiles. With over two decades of quantitative research and development, QRRS originated from EU-funded fintech innovation programs and leverages the computational capabilities of European supercomputing centers, including Barcelona’s HPC cluster.

Please find all live data and performance indicators in our live data room:

Adaptive Risk Recovery

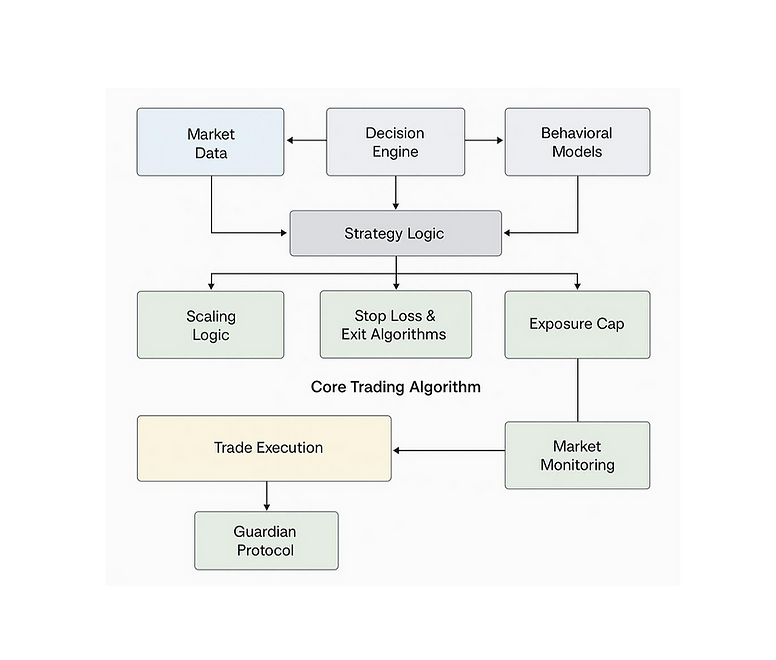

While traditionally associated with high-risk pyramiding strategies, QRRS replaces the legacy "Martingale" approach with an intelligent, adaptive position recovery framework. The system dynamically manages drawdowns and exposure using real-time market analytics and multi-layered risk triggers. Each currency pair operates with its own risk engine, incorporating individual stop-loss parameters and volatility-based scaling logic.

At the core of the system lies a global exposure limit (hardcut), which caps total portfolio exposure and acts as a structural protection layer to safeguard client capital during volatility spikes or macroeconomic disruption.

AI-Enhanced Signal Architecture

RRS combines deterministic trade logic with artificial intelligence modules to create a hybrid decision framework. AI models (including supervised learning and unsupervised clustering algorithms) assess both historical patterns and live market data to adaptively refine entry and exit timing. The result is a model that reacts not just to price but also to market context – enabling responsive trade sequences in both trending and mean-reverting environments.

Backtesting is conducted using multi-cycle data and Monte Carlo simulation, ensuring robust statistical confidence across varying volatility regimes and liquidity conditions.

Real-Time Oversight and Automated Interventions

QRRS operates on industry-standard MetaTrader infrastructure with direct broker integration via API. A proprietary 24/7 monitoring system tracks trade-by-trade execution, performance drift, and market anomalies. In case of deviations from expected return corridors or unusual market behavior, the system triggers automatic trade suspensions or strategy recalibrations in real time.

This real-time audit layer ensures operational integrity and gives investors full visibility over trade logic, execution quality, and portfolio behavior.

Infrastructure and Computational Intelligence

The trading logic is developed and deployed via the MetaTrader 4/5 ecosystem, enhanced by proprietary data ingestion layers and microservice modules. Backtesting and live validation are conducted on a HPC cluster environment, allowing for millisecond-level precision in strategy calibration across multi-year tick data.

AI-modules—predominantly based on reinforcement learning and probabilistic forecasting—are integrated in the decision layer to anticipate market regime shifts. These AI components are not autonomous trading agents, but auxiliary systems enhancing signal quality and contextual probability weighting for trade management logic.

Regulatory & Development Framework

The strategy was conceptualized and refined under strict documentation and compliance protocols, aligning with EU-funded fintech research initiatives. Source control, code audits, and backtest reproducibility are ensured via industry-grade versioning systems and regression testing environments.

This makes the Aurex strategy not only a robust tool for high-frequency asset rotation but also a fully auditable system for regulated portfolio inclusion, particularly when deployed through managed accounts or signal-based asset advisory structures.

Adaptive System Architecture

Conclusion

The FX Shield Alpha Algorithm represents a new generation of adaptive trading systems—engineered for risk-adjusted performance, institutional-grade resilience, and maximum operational transparency. It is not merely an automated execution engine, but a comprehensive trading and risk-control framework developed at the intersection of quantitative finance, artificial intelligence, and advanced capital protection protocols.