Blue Euro Alpha

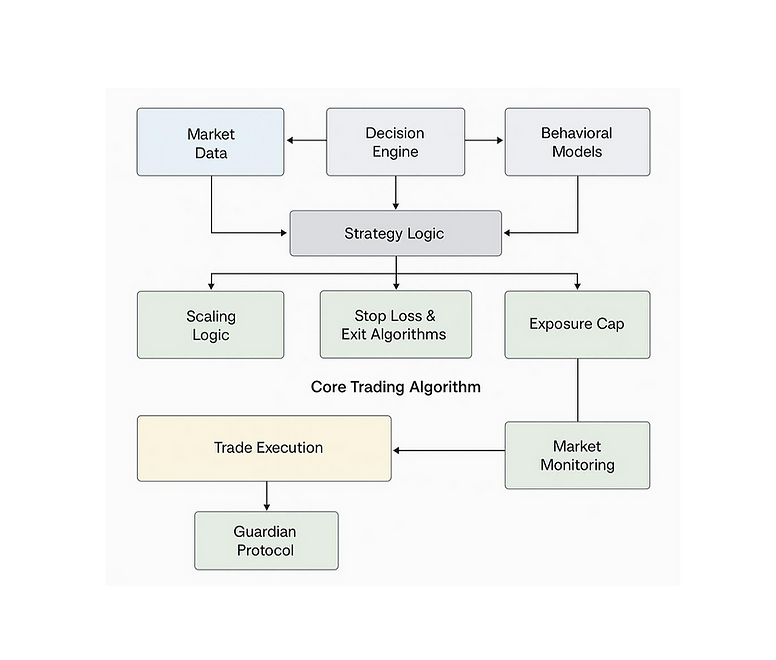

Algorithmic Strategy Architecture:

Dynamic Volatility Intelligence Strategy (DVIS)

The strategy is built upon the detection and in-depth analysis of the hidden dynamics within global financial markets. By using advanced volatility forecasting, the system extracts statistical insights that are subsequently transformed into profitable, risk-adjusted trading opportunities.

Please find all live data and performance indicators in our live data room:

Artificial Neural Networks

Unlike conventional approaches, the algorithm employs cutting-edge nonlinear modeling techniques powered by Artificial Neural Networks (ANNs). These models are capable of capturing complex, non-obvious market patterns and relationships that traditional linear methods such as Markov models often fail to recognize. As a result, ANN-based trading solutions have the potential to consistently outperform their linear counterparts in both profitability and adaptability to changing market conditions.

Risk Management Framework

The core of the algorithm lies in a fully systematic trading algorithm designed to participate in market movements under any conditions whether trending, range-bound, or highly volatile. The system’s architecture integrates a sophisticated and robust risk management framework aimed at minimizing drawdowns while optimizing returns. This includes dynamic position sizing, stop-loss calibration, and volatility-adjusted exposure control.

Market Insights

Focusing primarily on the EUR/USD currency pair, the strategy operates in a continuous 24-hour cycle, taking advantage of liquidity and volatility patterns across global trading sessions.

Based on fundamental analysis the algorithm is regulary adjusted. to perform under best market conditions.

Infrastructure and Computational Intelligence

The trading logic is developed and deployed via the MetaTrader 4/5 ecosystem, enhanced by proprietary data ingestion layers and microservice modules.

AI-modules—predominantly based on reinforcement learning and probabilistic forecasting—are integrated in the decision layer to anticipate market regime shifts. These AI components are not autonomous trading agents, but auxiliary systems enhancing signal quality and contextual probability weighting for trade management logic.

Regulatory & Development Framework

The strategy was conceptualized and refined under strict documentation and compliance protocols, aligning with EU-funded fintech research initiatives. Source control, code audits, and backtest reproducibility are ensured via industry-grade versioning systems and regression testing environments.

This makes the Aurex strategy not only a robust tool for high-frequency asset rotation but also a fully auditable system for regulated portfolio inclusion, particularly when deployed through managed accounts or signal-based asset advisory structures.

Adaptive System Architecture

Conclusion

The Aurex algorithm leverages AI-driven nonlinear modeling and advanced volatility forecasting to uncover hidden market dynamics and generate risk-adjusted trading opportunities, primarily in the EUR/USD market. Its fully systematic 24/7 algorithm combines adaptive neural networks with robust risk management to deliver sustainable, long-term performance across all market conditions.